The financial industry is undergoing a transformation driven by rapid technological change, reshaping how business is done. For fintech CEOs, this presents both challenges and opportunities. Staying competitive requires anticipating change and making decisions that position their companies ahead of the curve.

Understanding the Nature of Technological Disruption

Technological disruption is reshaping industries at an unprecedented pace, and fintech is at the forefront of this change. In an industry where innovation is core to survival, understanding the forces driving disruption has become essential for CEOs. Staying informed helps companies adapt but also positions them to seize opportunities ahead of competitors.

The fintech sector has experienced exponential growth, powered by transformative technologies that continue to redefine every corner of the financial landscape. Artificial intelligence (AI) and machine learning are revolutionizing how data is analyzed, enabling businesses to make smarter decisions, improve fraud detection, and offer personalized customer experiences. These tools have transitioned from optional advancements to essential components of daily operations.

Blockchain technology is creating secure and transparent systems for payments, lending, and global transactions while reshaping traditional processes. It offers unparalleled security and decentralization, putting customers at ease at a time when trust is crucial. Open banking, another key driver, has increased competition by allowing third-party providers to access financial data with customer consent. This approach democratizes financial services and puts consumers in control, pushing legacy institutions to adapt or risk falling behind.

These innovations are also altering customer expectations. Today’s consumers demand immediate solutions, intuitive interfaces, and secure systems. They show little tolerance for outdated processes or long wait times. Fintech companies able to meet or exceed these demands are thriving, while those stagnant in their strategies are quickly overlooked. This creates a high-stakes environment where staying innovative is no longer optional.

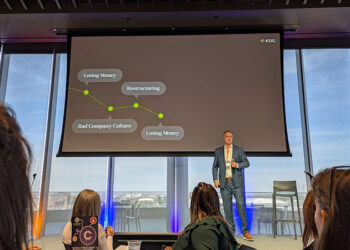

The Risks of Ignoring Disruption

“For CEOs, failing to adapt to technological changes can have serious consequences,” says Eric Hannelius, a seasoned Fintech entrepreneur and leader of Pepper Pay LLC. “The most immediate risk is the loss of market share to competitors that prioritize innovation.”

In a fast-moving industry like fintech, even a minor delay in adopting new technologies can lead to being outperformed by more agile rivals. Emerging startups often bypass traditional hurdles, pushing established firms further into defensive positions.

Additionally, outdated business models may struggle with increasing customer expectations. Technology is no longer a back-end support, it is driving the core value proposition of modern financial services. Organizations that refuse to invest in modernization risk creating frustration among their clients. Unsatisfied customers often seek alternatives that offer faster, more efficient, and more secure solutions.

Ignoring disruption can also leave companies ill-prepared for regulatory changes. As new technologies gain traction, governments worldwide are updating policies to ensure compliance and protect consumers. Falling behind in innovation also means falling behind on understanding or aligning with those regulations, engendering financial and reputational risks.

The danger of stagnation poses real threats, and as technology continues to advance, it has the potential to render entire service offerings obsolete. Companies that refuse—or hesitate—to embrace disruption may find themselves fighting a losing battle, unable to recover in an industry that rewards bold, forward-thinking leadership.

For fintech CEOs, maintaining agility is essential to navigating the ever-changing technological environment. Being agile means equipping teams and operational systems with the tools and mindset necessary to adapt without hesitation. Building an organizational framework that prioritizes adaptability ensures companies can evolve alongside new challenges and opportunities.

Creating a Culture of Innovation

An organization’s culture is its foundation, and a strong culture of innovation sets the stage for continuous growth. Companies that encourage experimentation and reward curiosity create an environment where teams feel confident exploring new technologies and processes. Without fear of failure, employees are more likely to propose creative solutions that could become game-changers for the business.

Leadership plays a critical role in fostering this culture. CEOs and executives must actively demonstrate their commitment to innovation by supporting forward-thinking initiatives and ensuring employees have the necessary resources to experiment. Setting dedicated time to brainstorm, pilot projects, or collaborate with external experts can ignite creativity across teams.

Open communication is another essential pillar. Employees, regardless of their role, need to feel their ideas are valued. Establishing accessible feedback channels and celebrating successful experiments reinforces the notion that progress isn’t always linear. It’s through iteration and trust that teams begin to approach challenges with a solution-focused mindset.

Investing in Flexible Infrastructure

Technological progress moves quickly, and rigid systems can become a significant barrier to growth. By investing in scalable and adaptable infrastructure, fintech organizations avoid the costly and time-consuming process of overhauling operations with each new innovation.

A cloud-first strategy is one way that firms can maintain flexibility. Cloud-based infrastructures are inherently scalable, allowing companies to adjust resources based on demand. Whether managing fluctuating transaction volumes, onboarding new clients, or testing experimental software, the cloud ensures seamless performance while keeping costs under control.

Interoperability is another crucial investment consideration. Systems that easily integrate with third-party tools and services position companies to adopt new technologies with minimal disruption. Legacy systems often lack this flexibility, making upgrades cumbersome and restricting access to next-generation capabilities. Proactively transitioning to modern, open-architecture platforms mitigates these risks.

Security can’t be overlooked. Agile infrastructure must be paired with robust cybersecurity frameworks that keep data safe while supporting quick adaptability. As the fintech industry embraces real-time payments, decentralized finance, and artificial intelligence, security threats continue to evolve. A flexible yet secure system prepares companies to protect sensitive information while remaining responsive to shifting technological norms.

Leadership Strategies for Thriving Amid Change

For fintech CEOs, leading during times of technological disruption requires reactive measures and demands proactive strategies that anticipate shifts and position organizations ahead of the curve. By establishing a clear vision, teaming up with tech innovators, and keeping customer needs at the forefront, leaders can navigate change with confidence while empowering their teams to innovate.

A strong strategic vision helps organizations weather unpredictable changes in technology. Fintech CEOs who adopt a forward-looking approach can better prepare for challenges and seize emerging opportunities. This requires outlining immediate objectives while anticipating advancements in artificial intelligence, blockchain, and other evolving technologies.

The future of fintech belongs to those who embrace continuous evolution. CEOs willing to integrate innovation, adaptability, and customer-centricity into their leadership strategies will define the next era of financial services. The ability to anticipate shifts, prioritize collaboration, and champion continuous learning ensures long-term relevance.

As technology accelerates, the leaders who prepare today will be the architects of a more dynamic, secure, and customer-focused financial landscape. By fostering a culture of resilience and innovation, fintech CEOs can navigate disruption and thrive in an era of constant change.